Table of Contents

- 【12月FOMC解説】政策金利見通しが上方修正もドル高は限定的<FX MARKET VIEW>|マネーサテライト(マネサテ) - 松井証券

- FOMC Meetings 2022 and 2023 | Casaplorer.com

- FOMC meeting ahead: the Fed is expected to stay put_Hawk Insight

- Fomc Minutes July 2024 - Carey Correna

- “6월 FOMC 점도표 ‘5.1%→5.6%’ 대폭 상향…7월 FOMC 추가 인상 가능성 높아” - 이투데이

- FOMC Gradually Lifts Funds Rate - Haver Analytics

- What is FOMC?- Everything You Must Know • Asia Forex Mentor

- US FOMC Set To Announce Rate Hike “Pause”, Bitcoin To Rally - 'CoinGape ...

- FOMC - AbhayKamden

- Decisão de Política Monetária do FOMC | BDSwiss Blog

What is the Federal Open Market Committee (FOMC)?

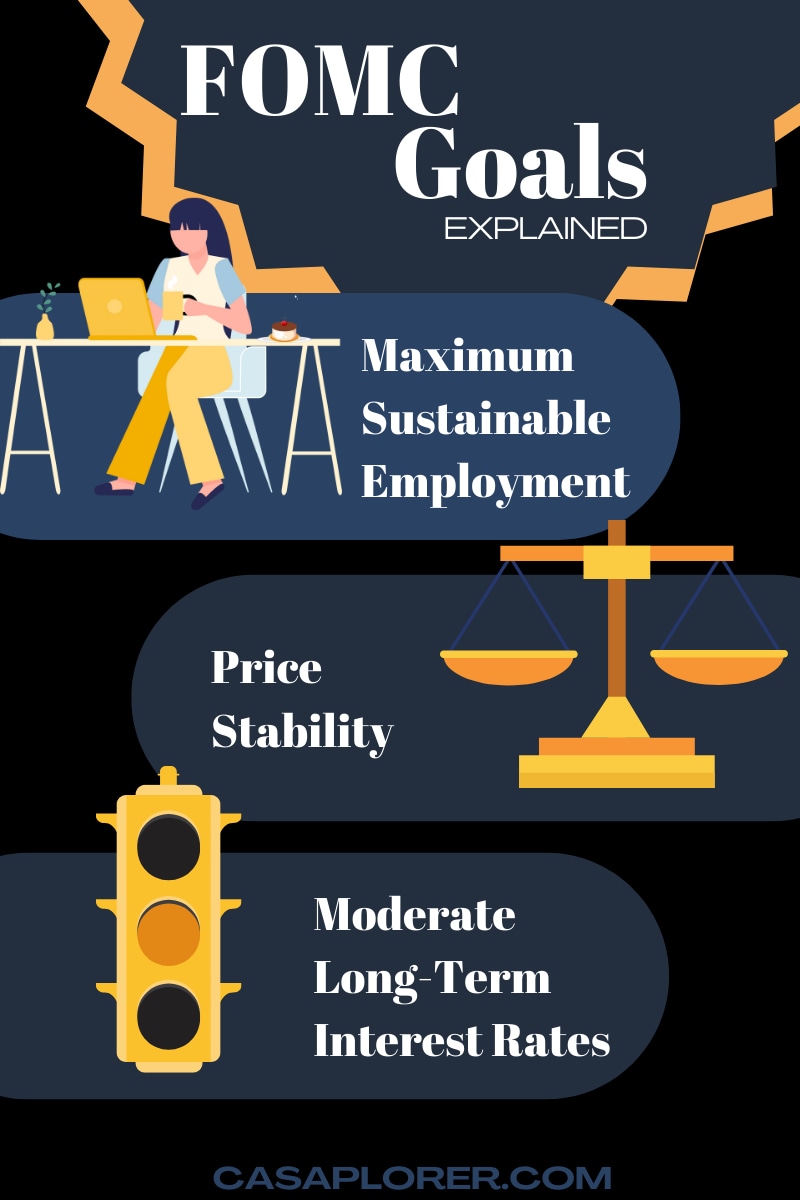

Functions of the FOMC

How the FOMC Makes Decisions

The FOMC meets eight times a year to discuss and set monetary policy. During these meetings, committee members review economic data, discuss the current state of the economy, and make decisions about interest rates and other monetary policy tools. The FOMC uses a variety of data points, including: GDP growth Inflation rates Unemployment rates Interest rates

Impact of FOMC Decisions on the Economy

The FOMC's decisions have a significant impact on the economy, influencing: Employment: Changes in interest rates and monetary policy can affect job creation and employment rates. Inflation: The FOMC's decisions can influence inflation rates, with higher interest rates reducing inflation and lower interest rates potentially leading to higher inflation. Stock market: FOMC decisions can impact stock prices, with changes in interest rates and monetary policy affecting investor sentiment and market volatility. In conclusion, the Federal Open Market Committee plays a vital role in shaping the United States' monetary policy, with its decisions having far-reaching implications for the economy. By understanding the FOMC's structure, functions, and decision-making process, investors and economists can better navigate the complex world of monetary policy and make informed decisions about their investments and economic forecasts.For more information on the FOMC and its role in monetary policy, visit Investopedia.